GENIUS Act: Ethereum Set to Dominate Stablecoin Market

Ethereum Poised to Capitalize on GENIUS Act, Experts Say

The GENIUS Act is anticipated to significantly increase the global use of stablecoins. Given its already strong market position, Ethereum is expected to benefit substantially from this growth.

Sanjay Shah, a researcher at Electric Capital, noted that Ethereum's blockchain possesses unique architectural strengths that will solidify its role as the fundamental layer for the expanding stablecoin economy.

Ethereum's Market Leadership

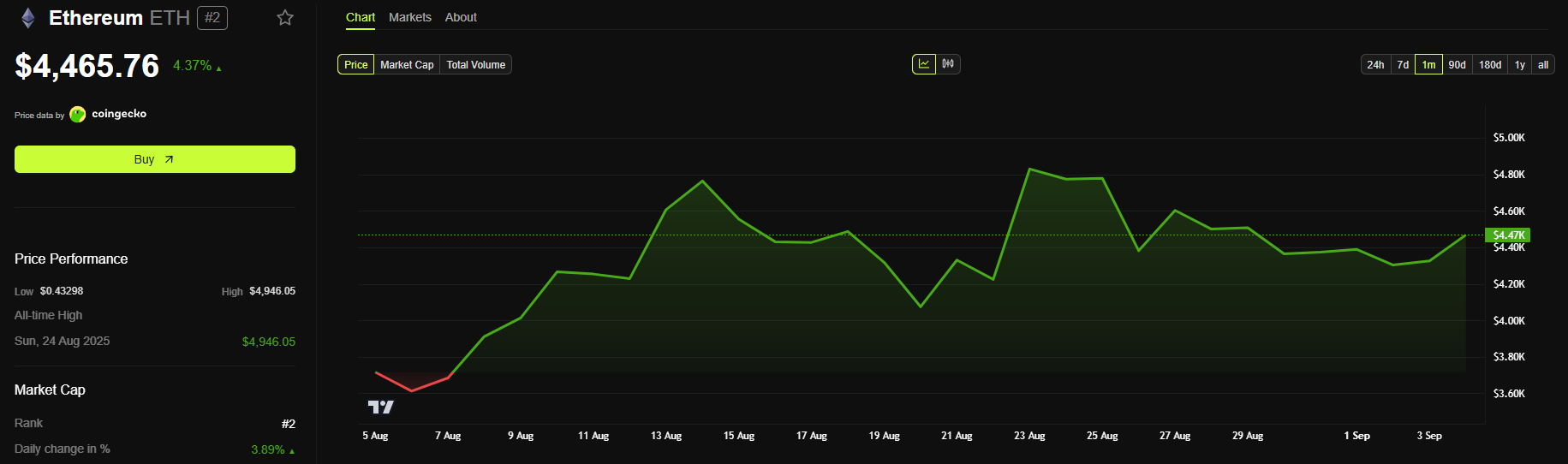

The GENIUS Act's passage triggered a market-wide cryptocurrency rally. However, Ethereum outperformed its competitors, demonstrating the most significant and sustained positive impact.

Leading up to the bill's approval, Ethereum's price surged, increasing by over 20% and surpassing $3,500. This momentum continued, with the network's value peaking at $3,875 the following week. Currently, Ethereum's price is around $4,465.

This robust market reaction has reinforced investor confidence in Ethereum's ability to leverage the new regulatory landscape. The GENIUS Act has streamlined the process for broader stablecoin adoption and easier global access to the US dollar, positioning Ethereum as a leader in this space.

GENIUS Act: A Financial Anchor for Ethereum?

Stablecoins are becoming crucial to the global financial system, serving as a primary rail for various transactions, including savings, payroll, and cross-border payments. The GENIUS Act's regulatory clarity is key to widespread adoption, enabling regulated institutions to issue and use stablecoins with greater confidence.

Shah suggests this shift will establish a new, open financial infrastructure, with Ethereum acting as its anchor.

"Regulated issuance will unlock distribution through banks and fintechs. Ethereum may anchor the open, global side of that system, with L2s handling high-throughput activity and L1 providing security and finality. ETH the asset may serve as the neutral, productive reserve collateral that underpins lending and other services across the finance stack," he stated.

Given that Ethereum already hosts the majority of stablecoin liquidity, it is poised to capture a significant share of this increased activity.

Ethereum's Strategic Positioning

Ethereum's existing dominance rests on three key attributes: global accessibility, institutional-grade security, and resistance to governmental interference. Legislation that emphasizes compliance and security further strengthens these qualities, attracting more participants. Currently, Ethereum commands over 52% of the $278 billion stablecoin market capitalization, according to DefiLlama.

"Ethereum may gain disproportionately from the GENIUS Act because it already dominates the parts of the crypto economy that the Act is likely to accelerate [like] USD-backed stablecoins and the financial services that grow around them," Shah added.

However, this surge in stablecoin demand will challenge network transaction processing capabilities, especially given Ethereum's history of scalability issues.

L2 Solutions: Addressing Scalability

Ethereum's scalability limitations have been a well-documented issue. Its mainnet has been restricted to processing a limited number of transactions per second, resulting in network congestion and increased transaction fees during peak demand.

As the GENIUS Act takes effect, the anticipated rise in stablecoin usage will place significant pressure on network capacity. Ethereum's long-term strategy to address these scalability challenges involves Layer 2 solutions (L2s).

These L2s will handle the majority of consumer and institutional stablecoin transactions efficiently and at a lower cost. The Ethereum mainnet (L1) will serve as the secure settlement layer, ensuring the finality of transactions processed on L2s.

"The bulk of consumer and institutional stablecoin throughput is designed to live on Ethereum L2s (e.g., Base, Optimism, Arbitrum), with L1 acting as the settlement and security layer, so scale comes from rollups while preserving Ethereum’s trust guarantees," Shah explained.

This system offers institutions flexibility and benefits, allowing them to choose appropriate trade-offs (throughput, fees, compliance features) within Ethereum's security framework.

Challenges to Ethereum's Dominance

While competing blockchains like Solana and Tron have made inroads in the stablecoin market, they are unlikely to displace Ethereum's long-term dominance.

The long-term success of a financial network depends on its foundational qualities. Decentralization and security foster a positive cycle that attracts capital and talent. Ethereum's proven security record and decentralized nature foster institutional trust, attracting substantial capital and liquidity. This robust ecosystem attracts developers to build applications and financial services on the platform, making Ethereum's position hard to challenge.

"Speed and cost are also important factors, but without the same decentralization, security history, and institutional customization options, it may be hard to dislodge Ethereum’s lead in finance," Shah argued.

The Path of Least Friction

While traditional financial institutions may explore launching private blockchains, they may gravitate towards open, public networks like Ethereum.

"Some banks will pilot proprietary or permissioned rails, but settlement liquidity tends to coalesce where counterparties already are. Private networks usually bridge back to where liquidity clears," Shah commented.

Although the GENIUS Act presents new opportunities for institutions, launching and managing a private stablecoin requires a considerable operational investment.

"The Act lowers the barrier for banks and fintechs to issue, but the path of least friction may remain issuing on, or at least interoperating with, Ethereum’s liquidity hubs and L2s to access global counterparties and composable finance," he concluded.

Current trends indicate that Ethereum will strengthen its role as the primary settlement layer for digital dollar transactions, supported by its rising price and growing institutional interest.