ETH Drives Record $4.39B Crypto Inflows

Ethereum Dominates Crypto Inflows, Reaching Record High

Ethereum (ETH) is capturing significant institutional interest for the third consecutive week, driving overall crypto inflows to a new record. The increasing demand for Ethereum reserve strategies has positioned the leading altcoin as a primary driver in the market.

The heightened interest in Ethereum is also influencing altcoins, sparking discussions among analysts about an impending altseason.

Crypto Inflows Surge to $4.39 Billion

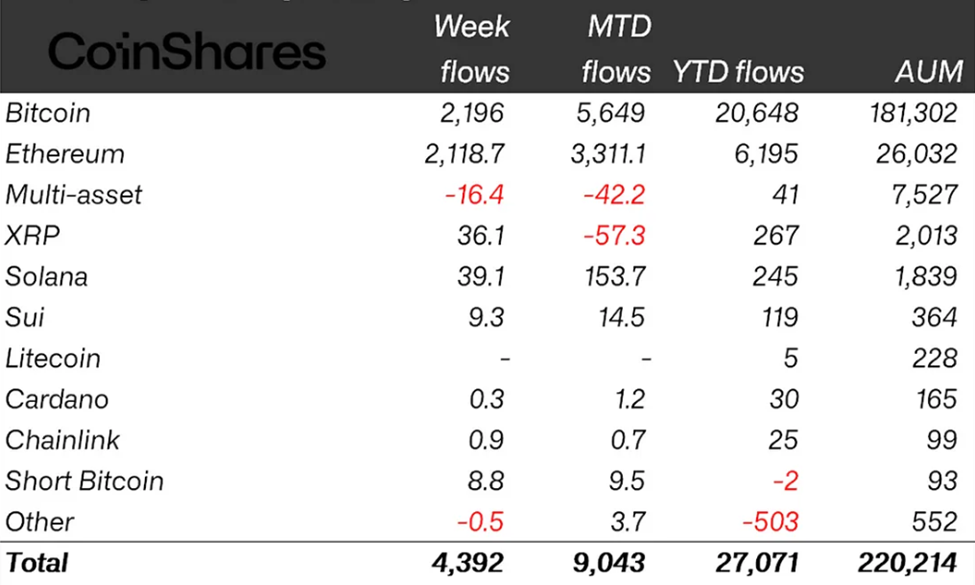

According to the latest CoinShares report, crypto inflows hit $4.39 billion last week, marking an all-time high for weekly inflows. This surge brings the year-to-date (YTD) positive flows to $27 billion, with assets under management (AuM) reaching a record $220 billion.

“Digital asset investment products recorded their largest weekly inflows on record, totaling $4.39 billion, surpassing the previous peak of $4.27 billion set post-US election in December 2024,” wrote James Butterfill, head of research at CoinShares.

This represents a substantial increase from the week ending July 12, which saw crypto inflows peak at $3.7 billion. This also marks the 14th consecutive week of positive crypto inflows.

Crypto Inflows Last Week. Source: CoinShares

Bitcoin (BTC) led with inflows of $2.196 billion. However, Ethereum's performance is particularly noteworthy, more than doubling its inflows in a single week. For the week ending July 12, Ethereum inflows were $990.4 million.

Last week, inflows into Ethereum products reached $2.1887 billion, a 2.1x increase in just one week. Bitcoin saw a decrease in positive flows, dropping from $2.731 billion to $2.196 billion.

“Ethereum stole the show, attracting a record $2.12 billion in inflows, nearly double its previous record of $1.2 billion. The past 13 weeks of inflows now represent 23% of Ethereum AuM, with 2025 inflows already exceeding the full-year total for 2024 at $6.2 billion,” Butterfill added.

The 2.1x surge in Ethereum inflows is fueled by accelerating institutional interest, with companies like Sharplink Gaming and BitMine now holding over $1 billion in Ethereum.

Ethereum's market capitalization has surpassed that of Goldman Sachs and the Bank of China combined.

Whales and ETFs (exchange-traded funds) have been injecting billions into the Ethereum market, with analysts suggesting a possible all-time high (ATH) soon.

However, despite Ethereum's impressive growth, some analysts advise caution.

“It’s time to start thinking about exit strategies… Bitcoin and altcoins are approaching the traditional 4-year cycle tops in terms of timing,” Ran Neuner, host of Crypto Banter, told his followers.

Benjamin Cowen, founder of Into the Cryptoverse, notes that many altcoins are underperforming Ethereum, indicating a late-cycle consolidation into major assets before a potential downturn.

Trader Daan Crypto Trades recommends investors consider rotating gains and managing risk to maximize returns amidst expected volatility.

Ethereum (ETH) Price Performance. Source: BeInCrypto

As of this writing, Ethereum is trading at $3,786, up by over 2% in the last 24 hours.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.

As a blockchain security and development platform, Codeum can help you navigate the complexities of the crypto market with our smart contract audits, KYC verification, and custom smart contract development services. We are dedicated to building a secure and reliable blockchain ecosystem. Contact Codeum today to discuss your project and ensure its success!