Bitcoin Price Soars Above $110K Amid Fed Rate Cut Expectations

Anticipation of Fed Rate Cuts Propels Bitcoin and Gold to New Heights

Gold reached a new record high of $3,508 in Asian trading, while Bitcoin exceeded $110,000. These surges are fueled by increasing expectations that the Federal Reserve will lower interest rates at its meeting on September 17.

Key Takeaways

- Gold reached a record $3,508 and Bitcoin topped $110,000 as traders expect the central bank to lower interest rates in September.

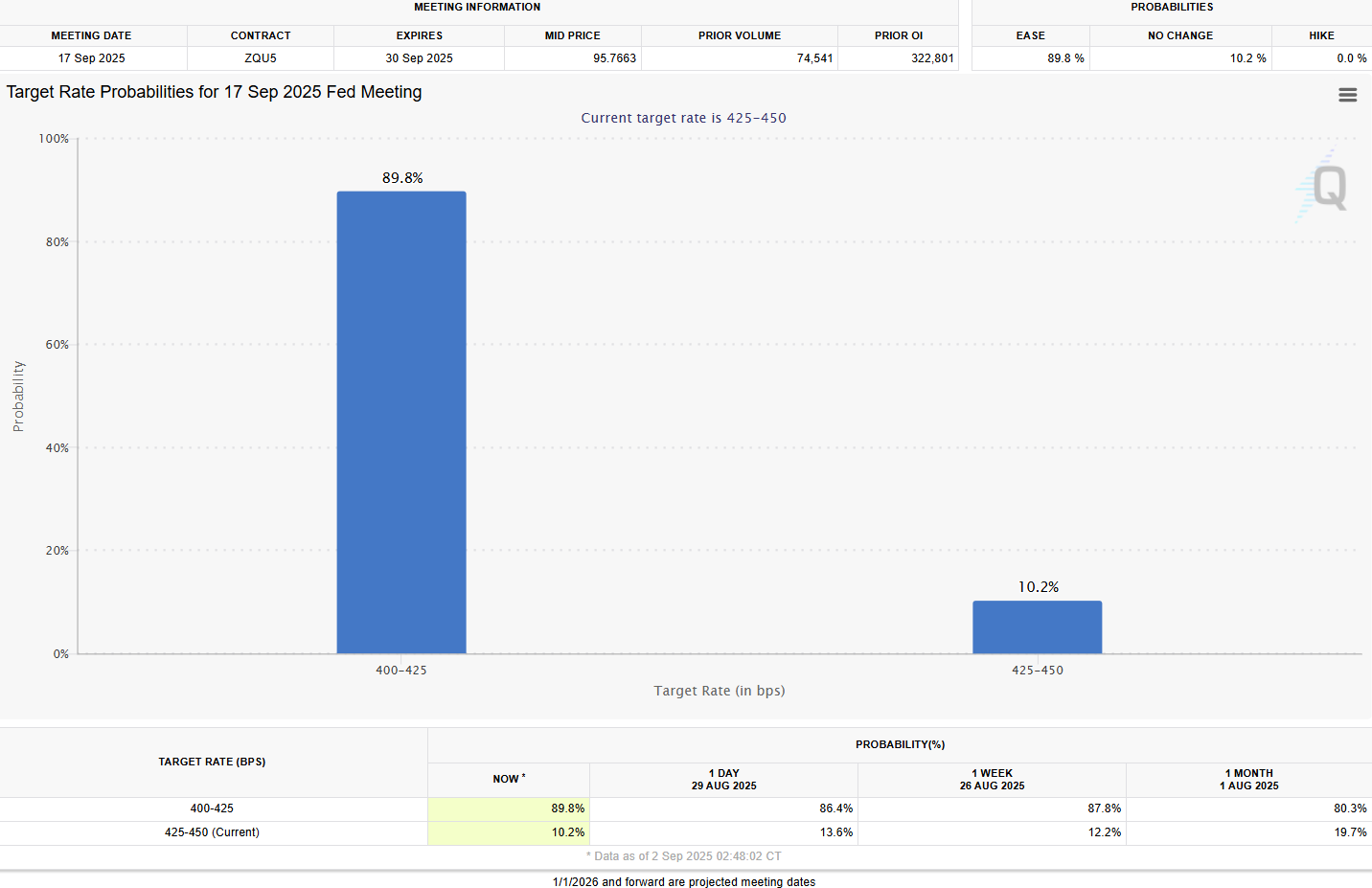

- Crypto and gold markets surged, driven by a nearly 90% probability traders assign to an imminent Fed rate reduction.

Rate Cut Probability Nears Certainty

The FedWatch Tool indicates a nearly 90% probability of a quarter-point rate reduction, a notable increase from 86% the previous day and 84% the week before. Such high odds were last observed on August 22, following signals from Fed Chair Jerome Powell suggesting a potential rate cut.

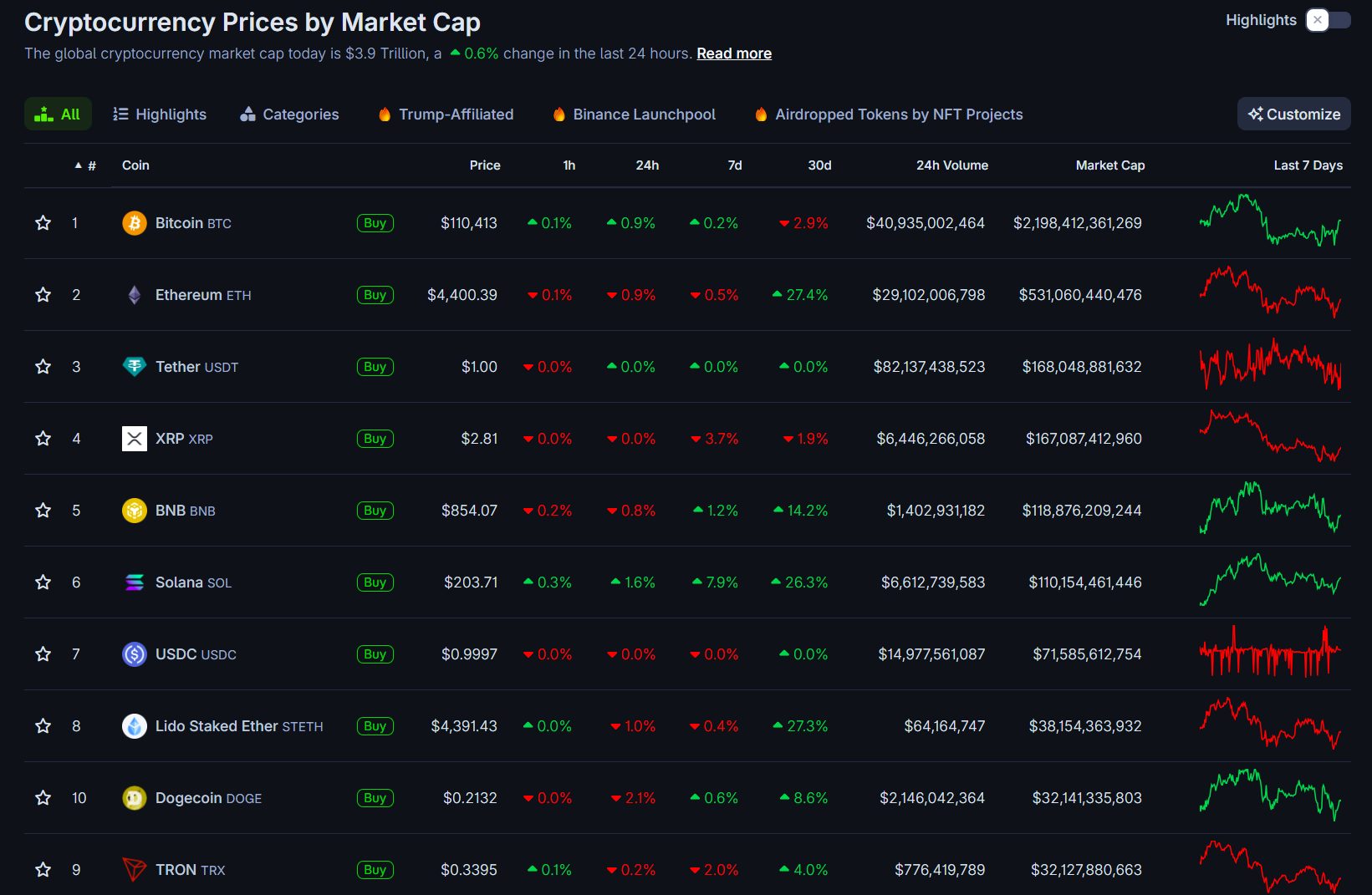

Crypto Market Reacts Positively

Bitcoin's rise from $107,500 to $110,500 has boosted the broader crypto market. Ethereum has surpassed $4,400, Solana is trading above $200, and other major cryptocurrencies have also seen gains.

The total crypto market capitalization has climbed to $3.9 trillion, reflecting a slight increase over the past 24 hours.

Analyst Insights

MacroScope, a noted analyst, views gold's recent surge as a positive sign for Bitcoin. The analyst recalls that in April, a similar gold rally preceded a Bitcoin pullback from $109,000 to $75,000, before the cryptocurrency diverged and reached new record highs. MacroScope suggests that Bitcoin might experience a short-term dip before another significant rally.

“Gold is screaming to be long BTC once this BTC retracement is done,” said MacroScope. “The last time this happened was below in April. Gold had just made a huge move to the 3400-3500 area. During that same time, BTC retraced from 109k to 75k.”

Upcoming Economic Data and Fed Developments“The inflection point was a positive divergence by BTC from risk assets. BTC then ran to new highs. Current timing unknown. And maybe a different inflection point. We’ll see,” the analyst added.

Investors are closely monitoring upcoming U.S. economic releases, particularly the August jobs report, for insights into Federal Reserve policy. The August inflation data, due on September 11, will further clarify the likelihood of imminent rate cuts.

In addition to economic data, legal and political developments at the Fed, including the Senate Banking Committee hearing for Stephen Miran, Trump’s nominee to the Fed Board, and the case of Fed governor Lisa Cook, are also under scrutiny.