Bitcoin Mining Centralization: 51% Attack Risk?

Bitcoin Mining Centralization Raises 51% Attack Concerns

Bitcoin, often lauded for its decentralized nature, is facing scrutiny as mining power consolidates. Recent data indicates a significant concentration of hash rate within a few major mining pools.

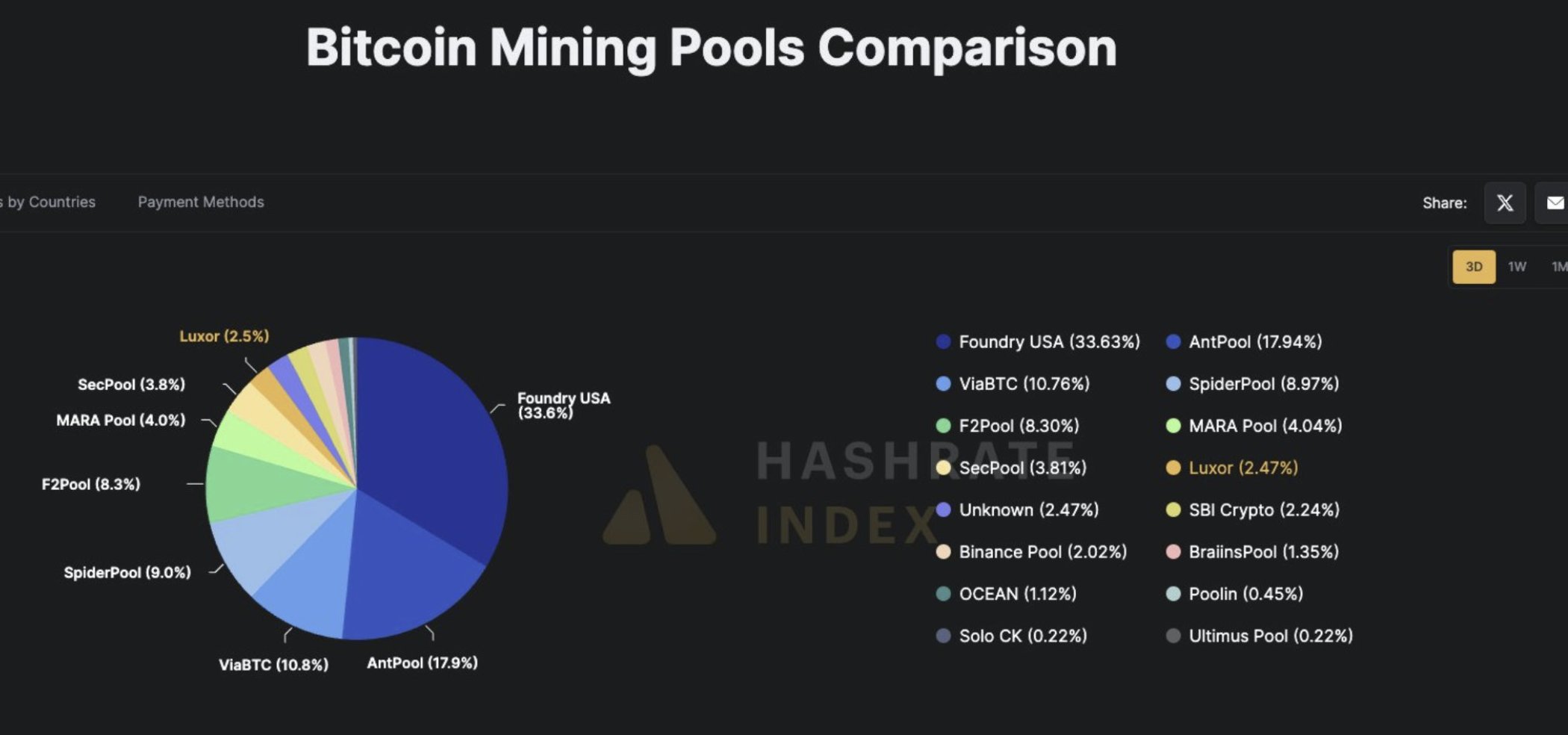

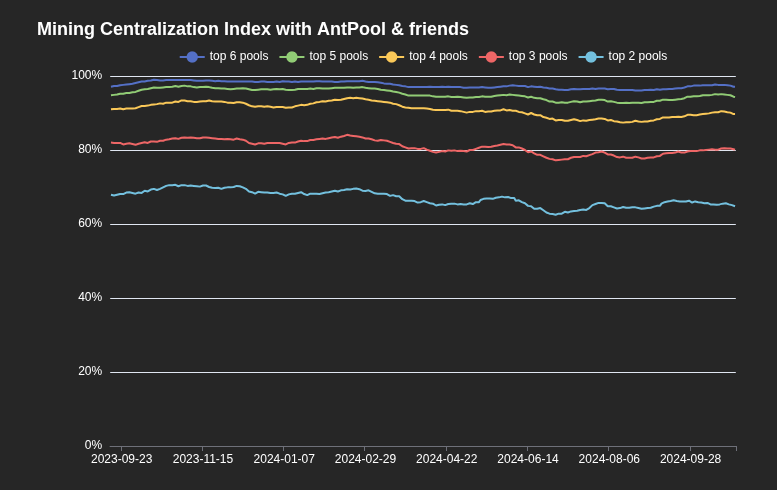

Data shows that two major mining pools currently control over 51% of Bitcoin’s total mining power.

This concentration raises concerns about the potential for a 51% attack, a scenario where a malicious actor or group could control the majority of the network's mining power and manipulate transactions.

Concentration of Mining Power

Analyst Jacob King reports that Foundry commands 33.63% of the Bitcoin mining hash rate, while AntPool accounts for 17.94%. The combined hash rate of these two pools exceeds 50%, signaling a significant centralization risk.

Community members like Evan Van Ness have observed that three mining pools often control over 80% of the global hash rate.

The Threat of a 51% Attack

A 51% attack would allow the controlling entity to manipulate transaction confirmations, potentially reversing transactions or enabling double-spending. This could severely damage trust in Bitcoin and lead to significant financial losses.

Some analysts suggest that this concentration could transform Bitcoin into a perceived “risk and burden” for institutional investors, impacting the broader financial system.

Is a 51% Attack Likely?

Experts emphasize that executing a 51% attack is extremely expensive, requiring significant infrastructure and energy resources. This high cost acts as a deterrent.

Furthermore, the economic incentives of mining pools themselves may discourage such an attack, as it would likely cause a collapse in Bitcoin's price, harming their own profitability.

Despite these disincentives, the perception of vulnerability to a 51% attack can generate significant concern among investors and raise worries about systemic risk.

As the Bitcoin landscape evolves, Codeum remains committed to providing blockchain security solutions and expert consulting to navigate these challenges, ensuring a safer and more decentralized future for cryptocurrency.